MicroSaaS Marketplaces for 2024

Introduction

The idea of why to build an app in a marketplace instead of a standalone SaaS is the fact that you can leave out so many variables that would just put more complexity into building a business. Even though there is a clear lack of control - the marketplace doesn’t like you or goes broke, then your app also loses all revenue. But there is a lot that it does for you.

For one, a good marketplace is a somewhat solved marketing and distribution channel. The people using these marketplaces to find solutions to their problems find them through the platform’s self-published place where these apps and integrations are listed. However, as I discovered building for Shopify app store, with too many apps this effect is lost as your app won’t stand out without additional marketing.

Another boon here is that building on top of these ecosystems should, in theory, be simpler. It should have fewer variables, like billing solutions, standardized listing pages, and certain rules and design language that you need to build in. This is all work you don’t need to do. This means that the focus instead can go deeper into solving actual customer problems.

As a disclaimer, it does not have to be an app on a marketplace. It can also be a course or an e-book, but I’ve found these to be also horribly saturated. There are different ways of building a MicroSaaS too in a way that does not quite follow the same abstraction of app on a marketplace, like building automations on Zapier, building an app with Airtable (not for Airtable), or supplying platform a functionality externally, like browser extensions for Notion.

Marketplace selection

Marketplace selection: size

Because I want to make sure that I have some kind of built-in discovery for the apps I build on either of the platforms, I have to understand how this process is going to look like. Once I’ve narrowed down the selection, I can look into how apps become featured and so on, but first I’ll check the size of the marketplaces at hand. I’m leaving out anything obviously huge, except a few as a basis for comparison.

I did a lot of counting by hand because a lot of the platforms don’t publish this information anywhere.

| Platform | App count | Notes |

|---|---|---|

| Airtable | 150 | Easy to stand out |

| Notion | 87 | Easy to stand out |

| Asana | 400 | Nonsensical big list of everything |

| Intercom | <1000 | Hard to find anything, or even count |

| Adobe Exchange | 5450 | |

| Trello | 300 | |

| HubSpot | 1573 | |

| Shopify | 9701 | |

| Microsoft Teams | 2189 | |

| Monday | 1144 | Surprisingly many apps for its size |

I’ve noticed that once the app count goes into high hundreds, apps start getting lost in the market. There is possibility of being individual category leader though. Like on Monday, even though in the general mix you’d get lost, then in a specific category you can still stand out. For instance, in the Finance category, there’s only 9 apps.

Marketplace selection: trends

Next, it is important that the marketplace is either pretty new or it is growing. If it is old, stagnant or shrinking, then I cannot imagine being able to find enough proper customers.

Using Google Trends

Of course, with these trends and estimating the relative activity, the issue is that the 100% high in the activity level might be very-very high in absolute terms, skewing all the other dates that we have the data for. But I think you can still eyeball the variance and running window averages and see whether the trend is shrinking or growing. Any statisticians can let me know if I am being completely off here. But for now, I see valuable data! I could have always downloaded the CSV data straight for Google Trends to do these calculations, but I think I don’t need this precise of a resolution at this stage.

Initially, I only queried for “platform_name integration”, but in hindsight I added “platform_name” as well to check the general health of the platform.

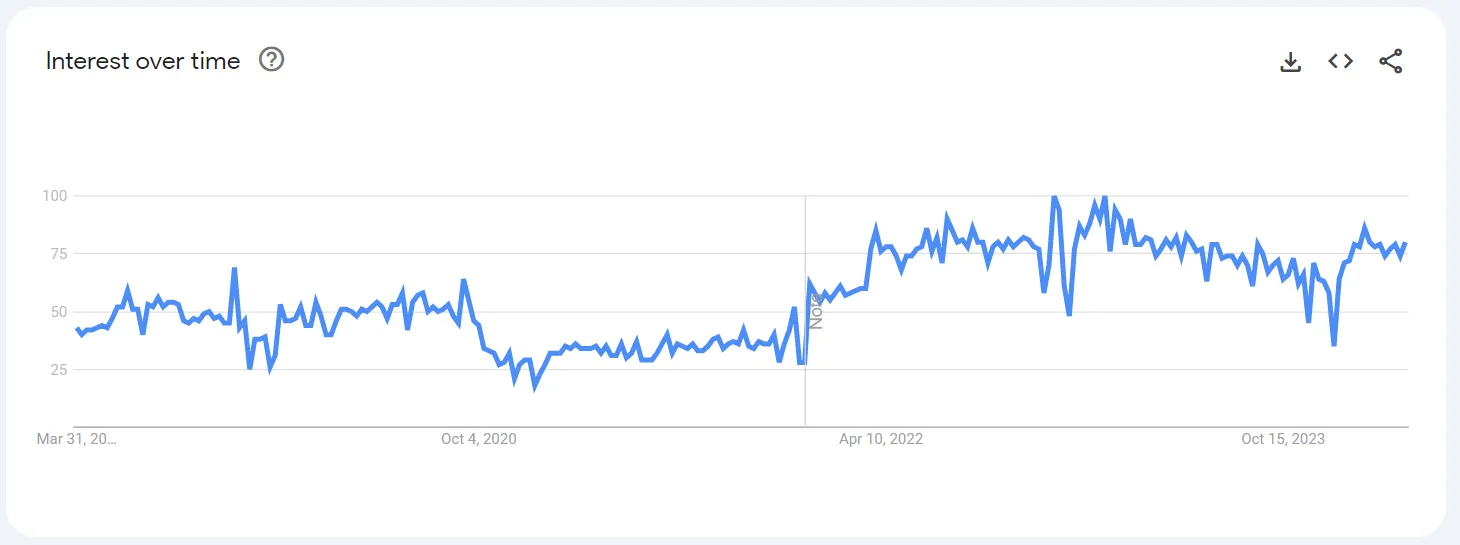

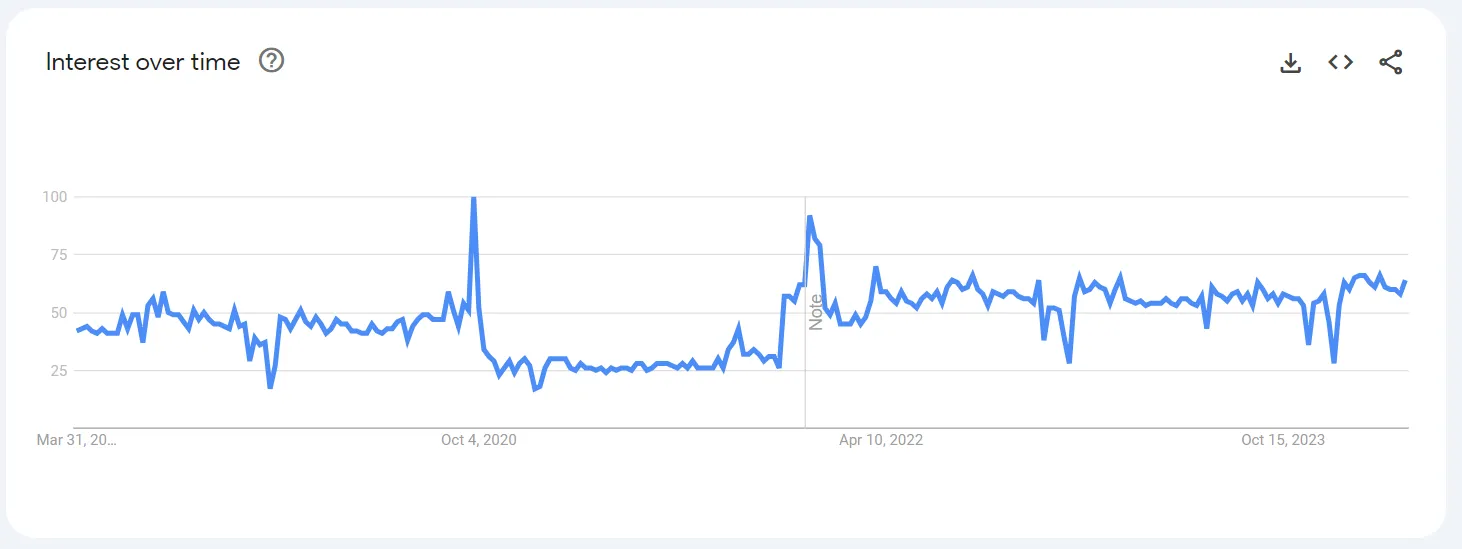

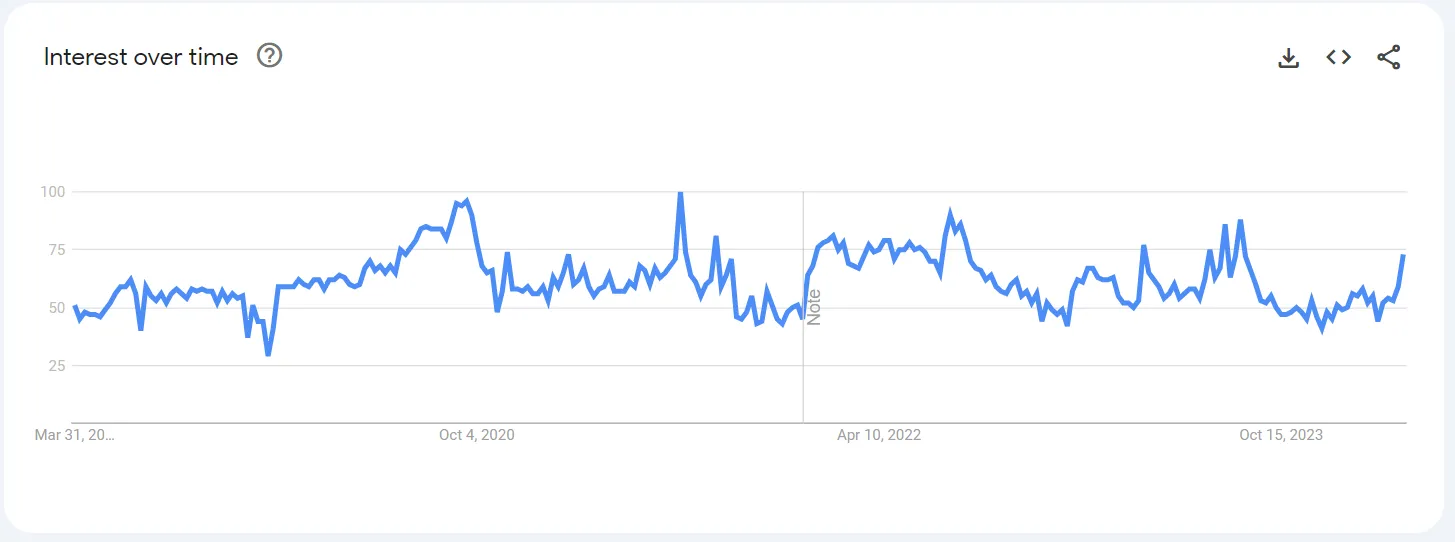

Airtable

“airtable”

“airtable integration”

Airtable itself seems quite healthy with no statistically significant drop-offs. If my eyes don’t deceive me, then it seems like 2023 has not seen a lot of activity. The marketplace started October 1, 2020. From April 2022 at 50% activity, it seems to have lowered down to at about 25% average activity. But that all might be just because of the general lack of popularity rather than serious churn.

I still don’t like the fact that this has been around for nearly half a decade, but isn’t so alive. I need to understand why. The situation here probably isn’t that you cannot do something extremely useful on top of Airtable as a platform. Maybe it’s because Airtable is only being used for very simple tables and the relationships between the tables by the people paying for it? I doubt that it is quite right, given the popularity of the platform. Nevertheless, I need to find out the ways the platform is being used, and maybe it is 99.9% just very basic stuff, which would mean that technically I’d have nobody to sell to.

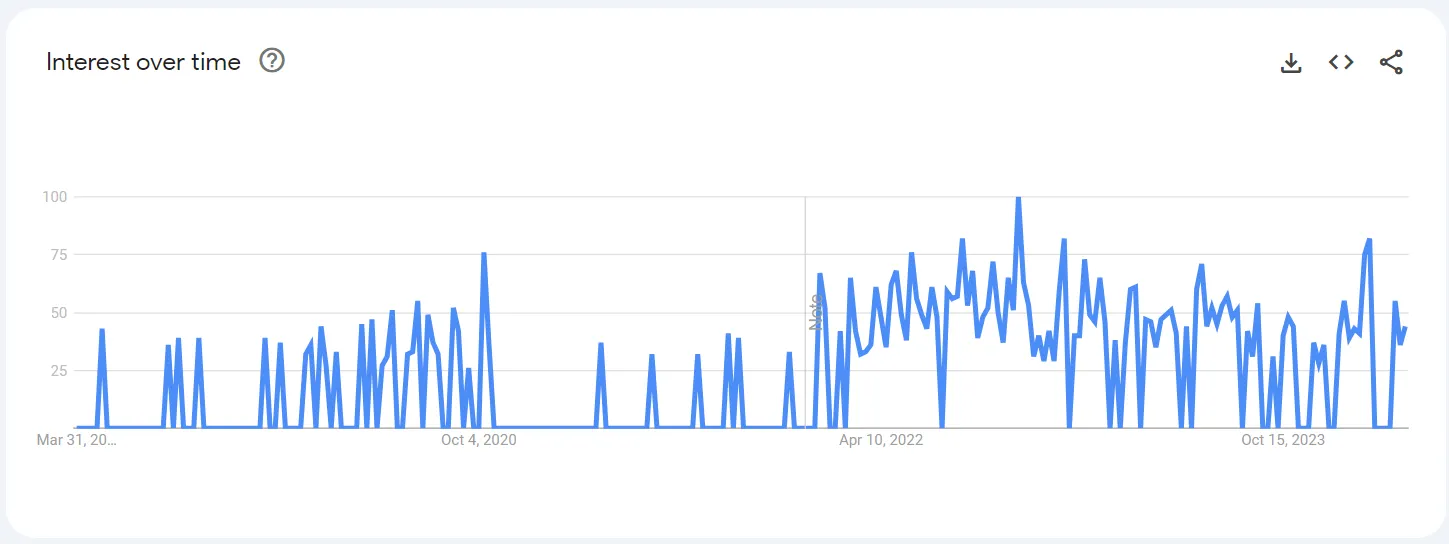

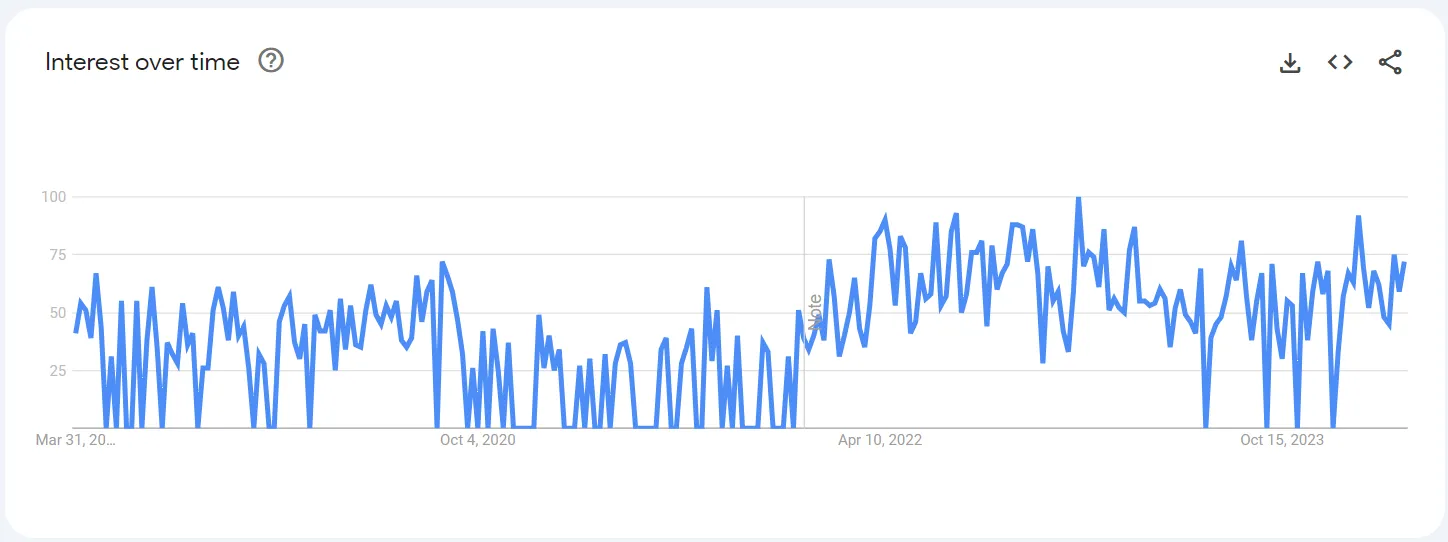

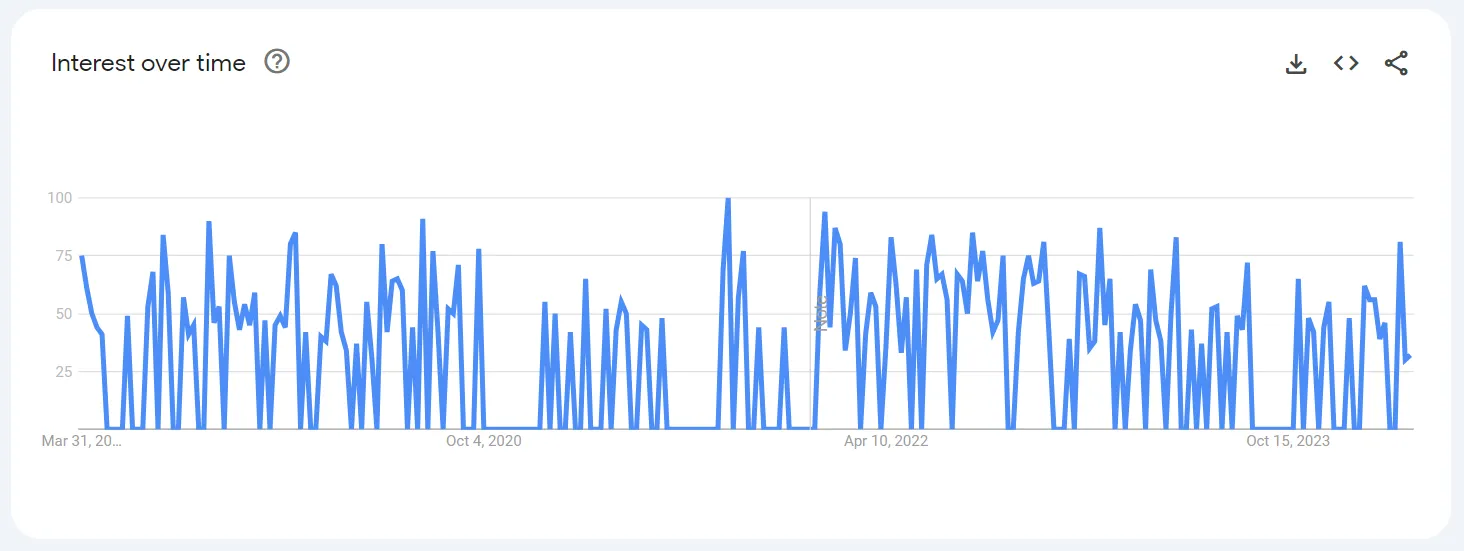

Notion

“notion”

“notion integration”

The marketplace started March 7, 2022. Seems like the trend is consistently increasing here from e.g. 47% to 60% by eyeballing it. This is supported by Notion’s general growth, which looks pretty significant. Notion is really going hard!

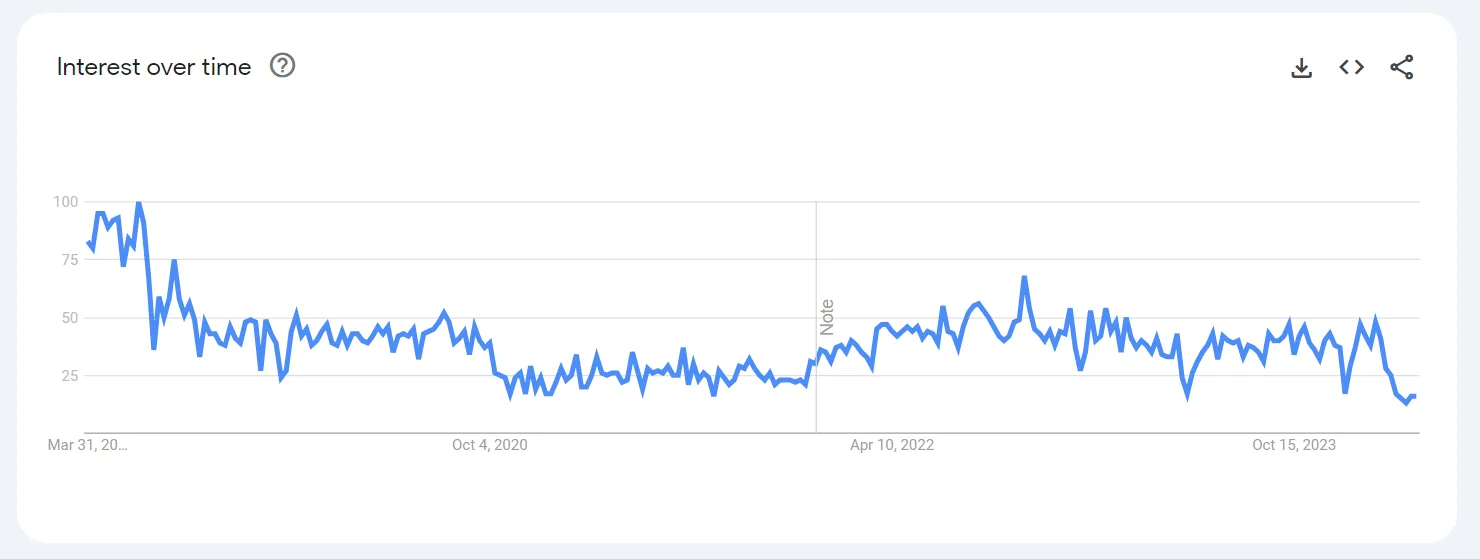

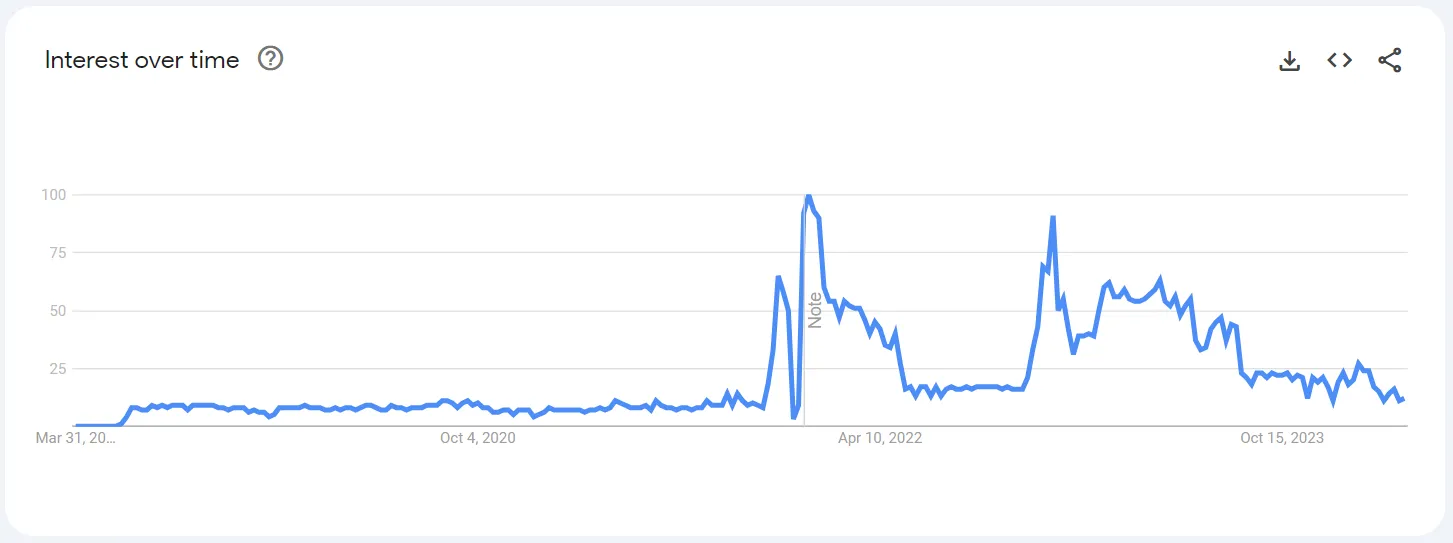

Asana

“Asana, Inc. - Software”

“asana integration”

Seems like it properly started in 2014 with its marketplace, so it’s been around for an entire decade! It’s old. Eyeballing the trends seems like it’s been stagnant or quietly decreasing from about 53% in April to 48% now. Mostly because it is so old is why there are probably systemic effects why the attached marketplace is not healthy.

Intercom

“Intercom, Inc. - Software Company”

“intercom integration”

The variance shows that there is very little volume here. Can ignore. I also tried contacting their customer support with questions about the platform, but I was never replied to.

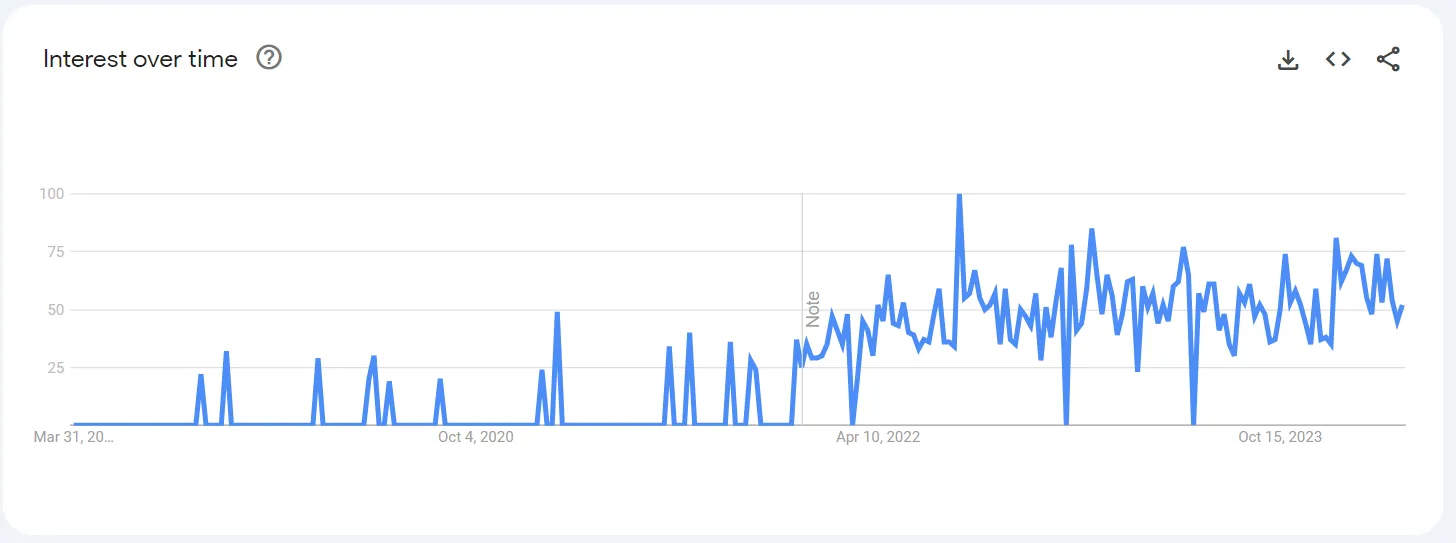

Trello

“trello”

“trello integration”

Another case of too much variance between 0 and high numbers, so this search isn’t stable, popular. It started in the first half of 2020. Nonetheless, the trend seems to be shrinking. Trello itself as a platform also seems to be slightly decreasing. This makes sense to me intuitively. I don’t see anyone really talking about Trello anymore. We have so many beautiful tools doing the same thing with more creativity.

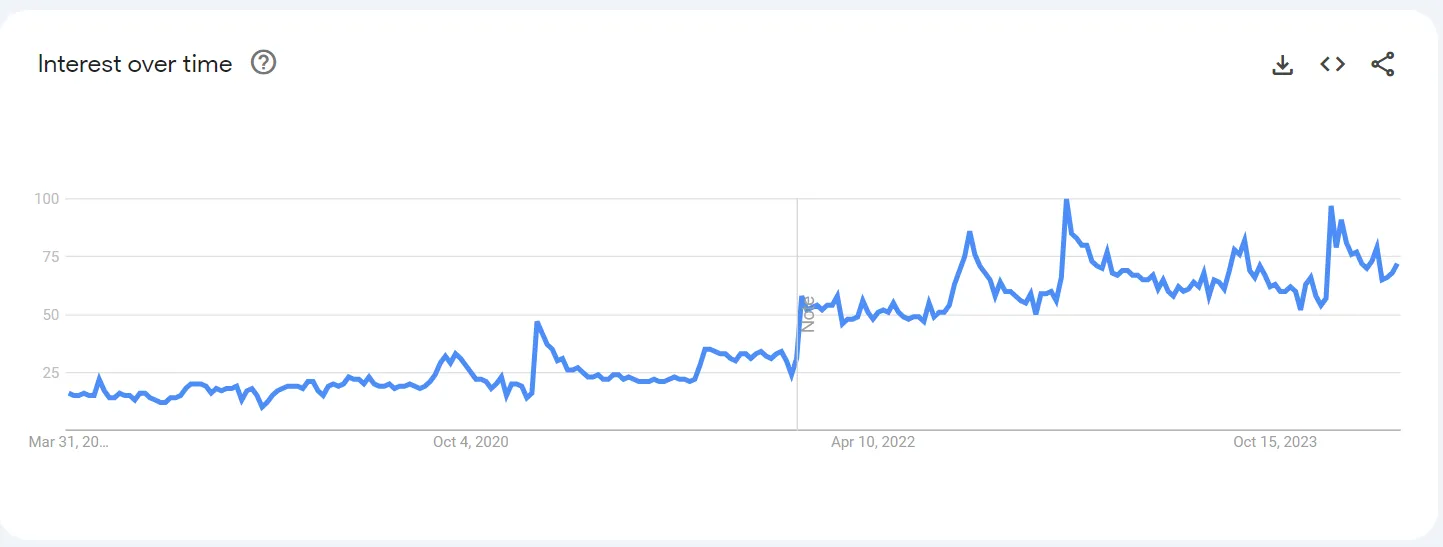

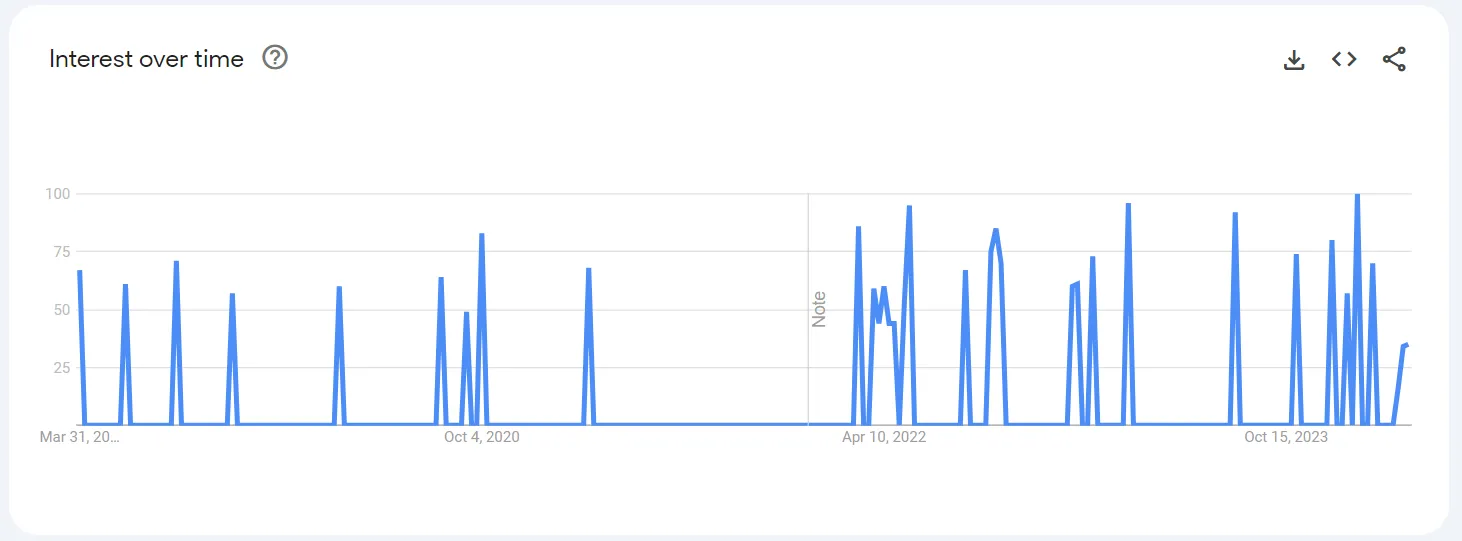

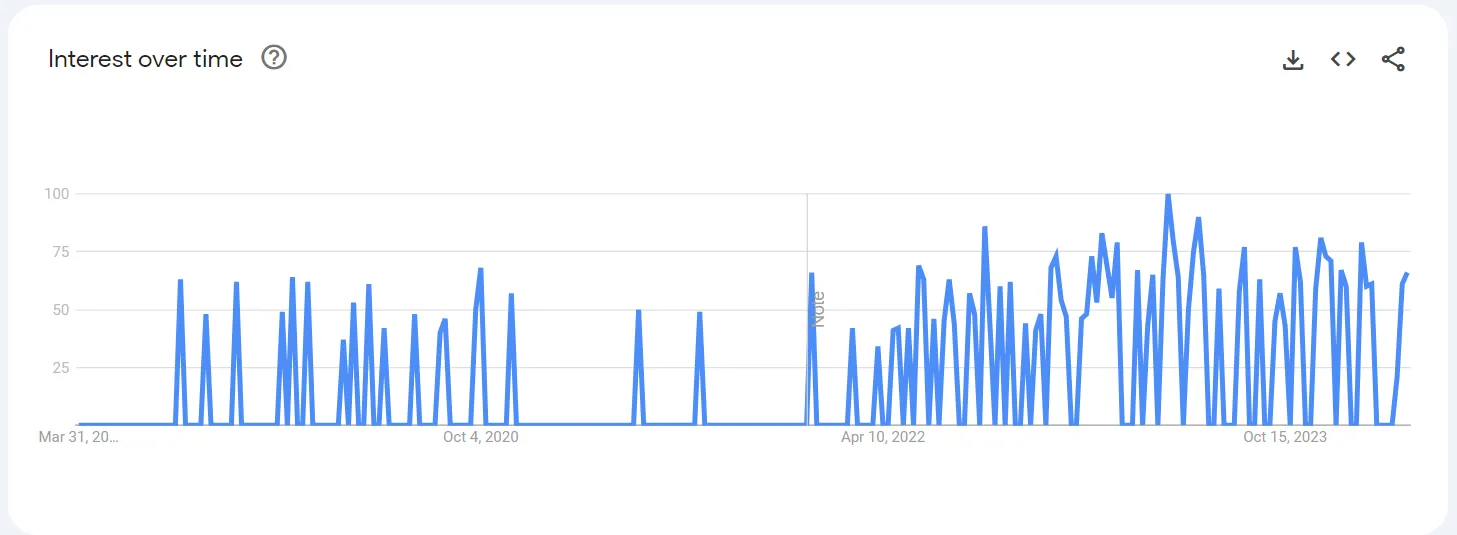

Monday

“monday.com - project management software company”

“monday integration”

I don’t know why there is so much variance here either. The marketplace started end of 2020. The trend nonetheless seems to be growing.

Looking at the general Monday popularity, the trends are pretty hard to read. It seems like there are 2 major events after which there’s a constant falloff in popularity. The last major event at the end of 2022 was because of a press release announcing their extreme revenue growth 58% YoY. Looks like this the year they also invested extra into the app marketplace with some kind of partnership. So at least this gives me evidence that this is probably pretty healthy. This is even with the apparent strong lowering of interest in the company.

What to think of this

Out of the options, seems like the only real options are:

- Airtable, because of clear app visibility and friendliness to developers. It is also only less than 4 years old.

- Notion, out of all of these, it seems to be the only one out of the smaller marketplaces that is actually growing. Also, there is a clear way for the apps to stand out, however, the process of getting apps released seems to be a bit more difficult. Notion’s marketplace is also only 2 years old.

- Monday, because even though the marketplace seems to be pretty unknown by the users of the platform in terms of online searches, the platform itself is somewhat growing. Monday also seems to have written a blog post on a similar topic, saying that there is low competition building on top of Monday. I am not sure how true that is. But the platform has over a thousand apps, so it only makes sense if I build an app in a less-frequented category. Which is actually a bit self-defeating if the point is to build something really useful. Also, if I see that there are over a thousand apps in the marketplace, but people of the platform aren’t really interested in using apps, then that sounds like a bad time. The insane variance for that “monday integration” search implies low search volume, but with more than a thousand apps I’d expect that graph to look much more stable. It’s probably too saturated for its demand.

Marketplace selection: Addressable market

I also need to figure out if these marketplaces have any capacity to make any money. For this, I can take a selection of some of the most popular apps that make most of their money on the platform, and estimate how much they’re actually making.

Notion integrations marketplace

![]()

For Notion there isn’t an app marketplace per se, but a collection of integrations. Most of third-party integrations are also supplied by Notion.

The issue here is that I would need something to integrate. And there probably aren’t a lot of tools that would allow me to hijack their brand to start making integrations for them for money, like e.g. doing integrations with Toggl. But I could always make a purposeful tool just for Notion, and then integrate that. It isn’t an integration in spirit, but an app. But might technically work.

Most of the integrations not by Notion themselves seem to be built by companies that have integrations with a lot of different platforms. I guess it somewhat makes sense. But that makes estimating the value of these a bit difficult. It seems to be full-blown SaaS apps like Marker.io, not MicroSaaS.

Because there are only 83 integrations, then there isn’t quite a lot of ranking either to sort them by, but I can explore around and try to find something that would simile the scale at which I’d build an app at.

This app is purpose built for Notion. It used to even have Notion in its name. Shopify wouldn’t allow to use their name in the app names, so it seems like this might be a decent tactic if they allow me to do that.

Now I am starting to realize there are no install numbers, there are no reviews. Which is good if I want to stand out from day 1. But that also means analyzing the existing market is nearly impossible. I wish there were at least some download numbers.

This app was popular on ProductHunt - I guess with Notion stuff it works well as Notion is generally loved. Funnily enough, this also had Notion in its name earlier on. I am pretty sure at this point Notion disallowed that practice later on.

For all the apps, pricing seems to be proper MicroSaaS levels, so that’s good at least. But they all seem so serious. I wonder if I can find some player that doesn’t have a magical full-blown solution out there.

It seems like there is only a single or two handful of apps that aren’t large SaaS apps. And everything is pretty high quality. I wonder if this is because Notion has really high standards, or is it because it used to be only strictly limited to some partners?

Our Integration Gallery features technology partners selected by our team based on their integration adoption, customer overlap and other factors. If you believe your integration may be a fit, you can learn more about the Notion Technology Partner Program and register your interest here. Please note that all featured integrations must be publicly available via OAuth, and will undergo a security and privacy review prior to being listed.

I do love the barrier to entry here, but then again, it seems like it depends heavily on existing solutions. And I wonder if it’s about making an integration, gaining traction outside the marketplace, and only then getting featured on it. It seems like you can install integrations even from outside the marketplace itself.

Integrations listed in the directory are a subset of all integrations available for Notion users. The directory includes all integrations that are built by Notion as well as other integrations that have been made by our partners and third parties. We are continuously adding more integrations to the directory.

So it seems like even though all of this is an amazing opportunity in itself, there needs to be a way to get to the point of getting listed first. So that means whatever app I’d be building needs to already be in popular use before Notion can help me market it in their gallery.

I wonder if there’s something out there already that a lot of people are using, but haven’t used the opportunity to get listed as a partner. Unfortunately, I couldn’t find any amongst the tools that are external to the platform, as I cannot estimate their quality or popularity very well.

So unfortunately I think Notion will stay as a second platform for me if I have solved a problem and think it’s a good idea to expand there.

I admit Notion seems to be an extremely attractive platform to build on for many analytical reasons and intuitive alike. But the overall chain of things to do to get an app published there is too long. It’s fine if it’s hard, it’s even good if it’s hard. But there’s too much risk multiplied by the number of steps you have to go through. I’d rather take only a handful of risks and hammer the risk out of them by doing good work. But this won’t work if there are too many risks. Still, if I have, say, a successful app on Airtable, then it’s likely I could expand to Notion, and that is a wonderful idea at that moment.

Airtable marketplace

![]()

The marketplace here seems a little odd. https://airtable.com/marketplace/category/all-apps

Most of the apps are open source extensions, but why? The 8 apps that are not open-source are at the top of the page, like the one app that converts any currency to Polish Zloty. This is insanely good visibility. That’s 154 apps in total. There’s 38 apps by Airtable themselves.

Let’s do the same as we did for Notion: find the apps that aren’t actually bigger apps outside Airtable, and that aren’t built by Airtable themselves.

- https://www.lomlabs.io/airtable/scripts/interface-sidesheet-link-generator

- https://airtable.com/marketplace/blketWdmOlr98JMZl/sidesheet-link-generator

Seems like this dev also only focuses on Notion and Airtable. https://www.lomlabs.io/airtable

- https://www.thepdfmaker.com/

- https://airtable.com/marketplace/blkfNaV2eti4YuIVd/pdf-maker-bustbrain-labs

By how the website looks, it seems like it has a lot of traffic to it too.

I tried figuring out how this app is open source, but it was just Airtable’s site that confused me. It wasn’t a heading, but a link to open source extensions. Meaning that almost none of the 154 apps are actually open source.

But then the question is - how are they ordered under all extensions? I consult archive.org to get a clue. It is not alphabetical, and it’s not based on how new they are. In October 2020, there were 54 apps. Six months later, 67. Six months later, 87. In 2023, the traffic had gone down because Airtable says they don’t support browser versions and that you should use the desktop app. But by today this is live again, so I guess they realized their mistake.

Seems like it is a mix of what Airtable wants to bring to the front and chronological. It seems like the more “random” apps are still lower down. I am not sure how the Polish app is so close to the top because it’s not old. I actually have a hunch this page might be completely manually handled.

Okay, back to finding good model apps.

From what I see, a lot of the developers once having solved a problem on one platform, it is usually also developed on other ones.

- https://heyolivehaus.com/airtable/automatic-linked-records/ (look at that website!)

- https://airtable.com/marketplace/blkUamFN0grsQERgz/automatic-linked-records

I really love the way she’s done this. I wrote her to ask for her opinions on developing on Airtable.

A lot of the apps I see in that list are bigger companies that do something else that is bigger, and have just solved a smaller problem for themselves that they share with others.

Checking the website of many of these developers, it seems like they’re abandoned - there are many obvious errors such as missing links, ungroomed pages etc. Which is a sign of poor health of the platform, or a sign of opportunity to do better.

Meanwhile, I figured out how the apps rank on that page: for official integrations from official partners and Airtable’s own apps - they’re just higher by default. But the other people all have recent updates to their apps which keep them higher up.

But I think that nobody really makes money on Airtable unless you’re really great at what you do and get more traffic somehow. Still, it definitely looks like a properly untapped opportunity. I’ll see what I could build here that would definitely catch eyes. Something perhaps from the world’s most popular Excel extensions?

Monday

![]()

https://monday.com/marketplace

Seems like even the new apps here though have at least 5 downloads, which is cool, if it doesn’t of course necessarily include the app developer’s own testings.

What I’m trying to figure out - do independent developers make money.

The apps don’t get many reviews. Even when they’ve been installed a lot. It could be a relatively recent feature then, as Freshdesk has 2k installs, but no reviews. I checked and reviews were added on May 2023. This is good, as it’s been only a year to catch up.

Sorting through the app selection is pretty annoying, as the native navigation is broken on the site and links don’t function as links. It’s a terrible single page application.

On Reddit and elsewhere, I hear a lot of hate for the Monday platform, mostly due to its slowness and bad customer support.

The right kind of apps are hard to find in the marketplace, but I am trying anyway.

321 installs in a year, no ratings, decent pricing, but no idea if anyone pays for it. Considering the cheapest option at $5/mo, with 30% of follow through after the free trial, and the average time of 6 months of using the app, then that would be about $578 of earned total income for the year.

- https://monday.com/marketplace/88 from some of the older apps like this one have 6256 installs from December 2020, at a basic level of $3/mo. Even though I feel like this app is probably used longer, let’s just assume 6 months of lifetime here again with 30% of follow through from trial. That’s about 1876 committed customers paying 18 dollars total. Even though it’s 3.5 years since the start, that’s about $34k total. But of course with any good app, the returns keep increasing.

Either way, it seems like it doesn’t matter much if the app is $3 or free; they seem to generally be comparatively popular.

It seems like this isn’t the main thing they do, but I like this solution:

It seems to be doing just one thing well. But it’s free for some reason. I guess that’s just to drive more consultancy sales to their business.

Either way, the fact that even the newest apps are installed, at least to some extent, show me that having early conversations should at least be possible.

Initially, I thought Monday was too saturated, but going through the app list and seeing how things actually are, I think there’s actually space for new apps, especially so in some less frequented categories, and specific integrations.

Outroduction

I don’t think there are quite right answers other than to pick one and go at it and see how the market responds.